Top 3 Reasons Banks Charge The Most For Merchant Services

In this blog post we will outline the top three reasons a bank charges the most for merchant services. Also known as, credit card processing. No matter what type of business you have, this will affect your bottom line. Utah EZ Pay wants you to know the difference between doing business with a bank and a merchant service provider (MSP) for processing your credit and debit card transactions. Here in the post we will outline the difference between the two.

Should I Trust My Bank For Merchant Services?

As our team members over the years had visited with many business owners, we have noticed a trend. That is, many business owners feel a sense of security opening up a bank offered merchant service account thinking they will give them the best deal. However as we will review, that is far from the case.

Remember, banks are all about making money off of rates and fees. Yes this is also true for merchant service providers. However there is a big difference. Below we will showcase the difference between processing with a bank vs a merchant service provider.

1 – Rates. Processing With A Bank VS a Merchant Service Provider.

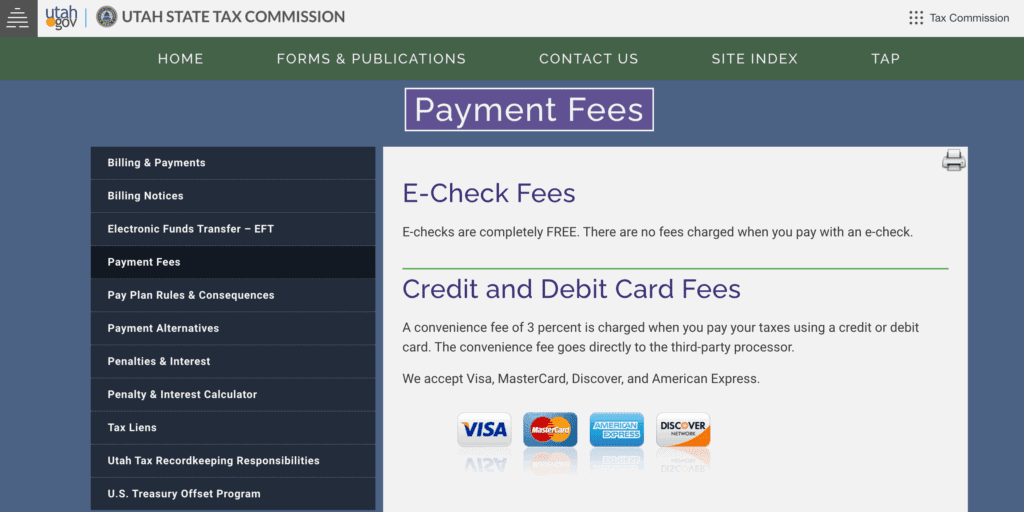

A Bank – Rates: Lets tank about bank offered merchant services first. Most banks don’t own and or use their own merchant service company. They often use use a third party MSP instead to process card transactions for their customers. So having discovered this, we see that a bank in most situations are the middle man.

They are in a way reselling the cost to them for processing your business card transactions, adding fees on top as a way for them to make money. Then charging business owners more, over and above what they could be paying should a business owner process directly with a merchant service provider. So in short, most banks are just simply reselling and often rebranding merchant services.

A Merchant Service Provider – Rates: Now let’s discuss about a merchant service provider, also know as a credit card processing company and how they differ from a bank. Here is where the big difference comes in as opposed to running cards for your business through a bank to process your card transactions.

When running card transactions with an MSP you are cutting out the middleman that is reselling the services, yes the bank. Your transaction cost will drop a lot and you will notice your rates are much lower. Your total effective rate will drop. Business owners will have more money in their pocket as a result. You will also have more rate options to choose from.

# 1 Rates Offered Recap

A Bank

- Most banks are not merchant service providers and are the middleman

- They are reselling merchant services

- Most if not all tellers and managers have no idea they are the middleman

- You will pay the highness rates and fees with a bank

- Limited rate offerings

A Merchant Service Provider

- They are direct and eliminate the middleman

- Not reselling merchant services

- Most if not all MSP’s are well versed in their field

- You will receive much better rates and fees

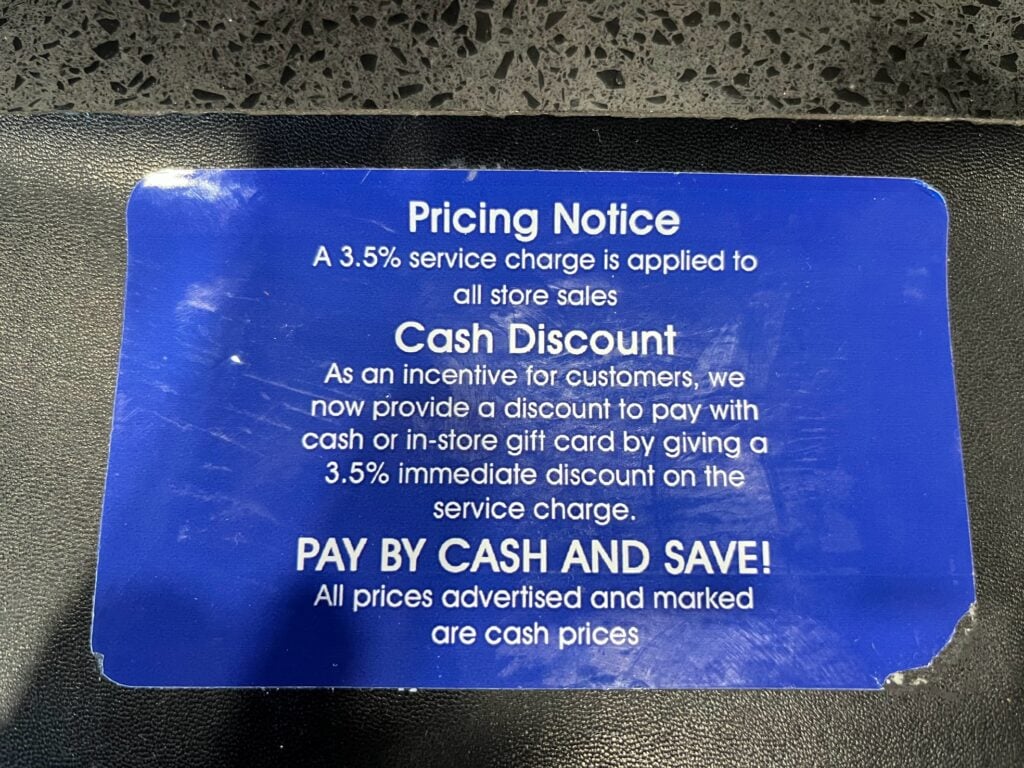

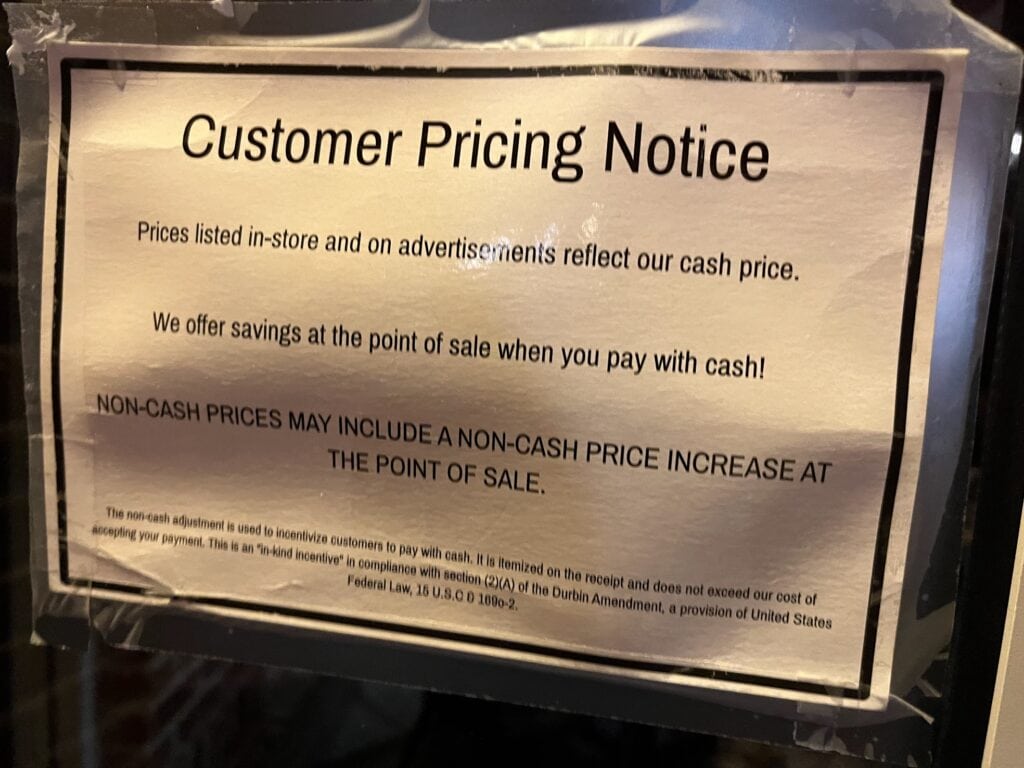

- Will have several rate offerings such as, 0% dual pricing, as well as, tiered .39% for instance as well as interchange plus pricing

# 1 Rates Conclusion

90% of the time you will receive much better rates processing card transactions directly with a merchant service provider vs a bank.

2 – Equipment. Processing With A Bank VS a Merchant Service Provider.

A Bank – Processing Equipment: Banks have limited access to credit and debit card processing equipment. The 3rd party they use, the merchant service provider, gives them a few of the most popular types of processing equipment. They will only have the most popular credit and debit card processing equipment at a cost to them. If you need an innovative solution, banks will not offer this to their merchants (business owners). Since banks are using a 3rd party for processing equipment, they often charge more for rates to make up for this.

Consider this, the person at your bank are surrounded by other bankers. Not like the people in merchant services that are detected to that field and surrounded in processing equipment and lingo.

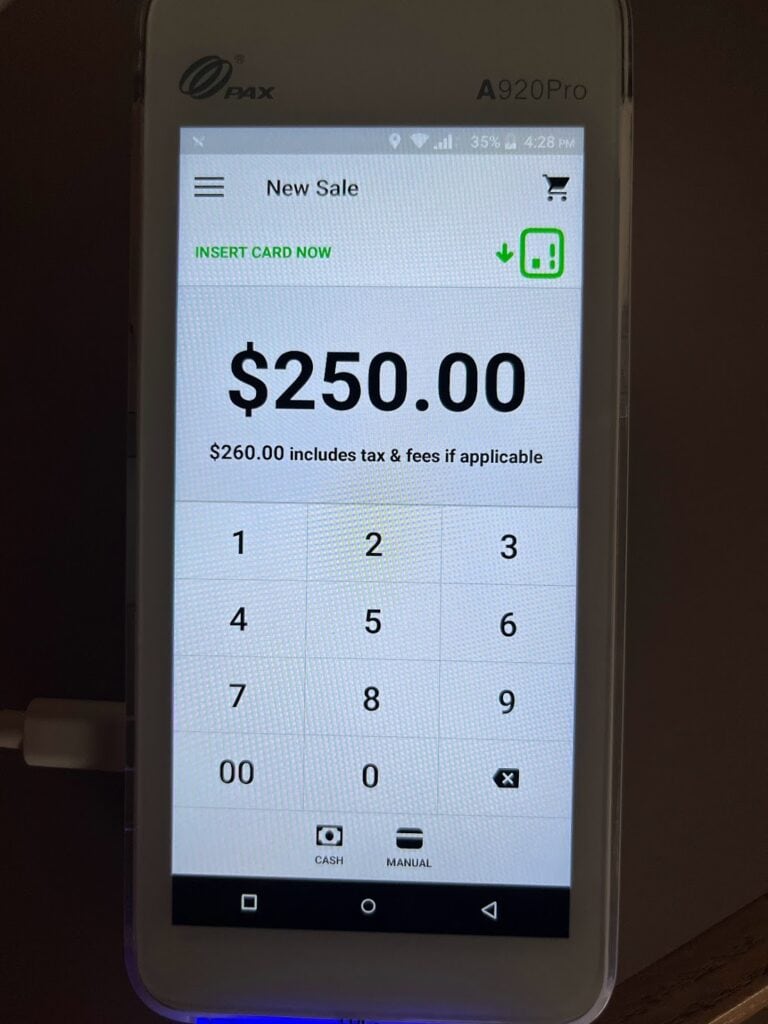

A Merchant Service Provider – Processing Equipment: Here is where a merchant service provider really stands out from what a bank offers it’s merchants. No matter what type of business an owner is running, they will certainly find an innovative solution to their needs. That is their job, every day.

Here you will find a wide variety of free offerings because this is what an MSP does for a living. From Smart terminals, to innovative POS systems and website e-Commerce solutions and options. This will result in lower rates and fees because unlike a bank, the merchant service provider buys equipment in bulk. Resulting in a lower cost to them and passing it on the to merchant. Also, has much more processing verticals and knowledge.

# 2 Equipment Offered Recap

A Bank

- Banks have limited credit and debit card processing offerings.

- Bank tellers and employees are not well trained in this other line of work. They are well trained in banking, not merchant services.

A Merchant Service Provider

- A merchant service provider has a plethora of credit and debit card offerings.

- Merchant service reps and employees are well trained as this is what they do for a living.

# 2 Equipment Offered Conclusion

Banks only have limited payment processing options as card processing as this is not their main line of work. A merchant service provider has many card processing options as this is their main line of work.

3 – Customer Support. Processing With A Bank VS a Merchant Service Provider.

A Bank – Customer Support: Banks will often have their merchants call a 1-800 number if their merchants are having an issue. Again the merchant (business owner) will be calling a 3rd party service that the bank has chosen to do business with, merchant service provider. Some banks do have a customer service local number a merchant can call. As far as having a local representative come out to their business to check on them, banks score a zero on this. This drives their rates up because they are using a 3rd party for customer support.

A Merchant Service Provider – Customer Support: Here is another area where there is a big difference between the two. When your business is processing cards and an issue arises, they can call a 1-800 number their account is set directly up with. Merchants also have another option. They can call their local representative that helped them set up their credit and debit card processing account. We call this in the business, your local rep. A MSP such as, North American Bancard (NAB) for instance, has an outside agent program. They are relationship builders between the company they work for, NAB, and the merchant, the business owner. They are there on the local level to make sure all is going smooth. A merchant service provider scores 100 on this as apposed to a bank. Also, in-house provided customer support allows for lower rates by eliminating the 3rd party middle man.

# 3 Customer Support Recap

A Bank

- In most cases, a business owners will call outside of the bank for support to a 3rd party.

- No local representative to come by your business and help with processing equipment if ever needed.

A Merchant Service Provider

- Business owners will call their merchant service provider directly.

- Your business will have a local representative to come by your business and help with processing equipment if ever needed.

# 3 Customer Support Conclusion

By having your credit and debit card processing account set up directly with a merchant service provider, you will experience much better customer service. Plus you will also have a local representative that you can call or text message at any time.

Bank Merchant Services In A Nutshell

The banking vertical is banking. They are not in the merchant service business.

The merchant service vertical is, well, merchant services. AKA, credit card processing.

In short, you can see the top 3 reasons banks charge more to their customers for merchant services. Thank you for reading this blog post about the top three reasons banks charge the most for merchant services. Sincerely, Utah EZ Pay and Greg G. Kapitan.