Four Benefits Of AMEX OptBlue

Utah EZ Pay is proud to bring this informative post to your attention. Business owners have known for a long time that acceptance of American Express cards means they will be paying a higher card processing rate. This was the case for many years in the past. Well, a lot has changed. In this post we will outline how AMEX has changed their game to be more competitive with the other card brands. Here’s too, the Four Benefits Of AMEX OptBlue.

1 – New Lower AMEX Processing Rates

American Express OptBlue offers merchants lower AMEX processing rates as it is a more affordable way to accept AMEX cards. Much to the relief of business owners across the country. OptBlue from American Express is a way for merchants to accept AMEX cards at a full 100 – 200 basses points lower. This = 1% – 2% less in cost.

To be honest, it is believed that AMEX was under presser from merchants as it has been for many years. This was due to the obvious pricing issues.

Long Gone High Processing Rates For AMEX Cards

As a matter of fact, AMEX cards are historically the most costly cards for merchants to accept. Merchant service providers wold often hear of merchants who were not happy with the AMEX cost. As it has been know for years to business owners that accepting American Express cards was the most expensive.

Many business owners refuse to accept American Express cards just for that reason. The processing rate range was form, 2.89% – 3.50% +. As apposed to Visa, Master Card and Discover was in the .39% 1.29% – 2.85% range excluding PIN based debit cards.

2 – All Transactions Will Be On One Statement

With AMEX OptBlue, merchants will now be able to view all transactions on one single statement. This will no longer be with American Express. It will be with your merchant service provider. Business owners will receive their Visa, Master Card, Discover and AMEX transactions all on one statement. This will include all of the details such as, amounts, batches, fees and all other information usually provided.

Separate Statements Are A Thing Of The Past

In the past, your AMEX card transactions came through a different funding path. This also meant another separate merchant statement.

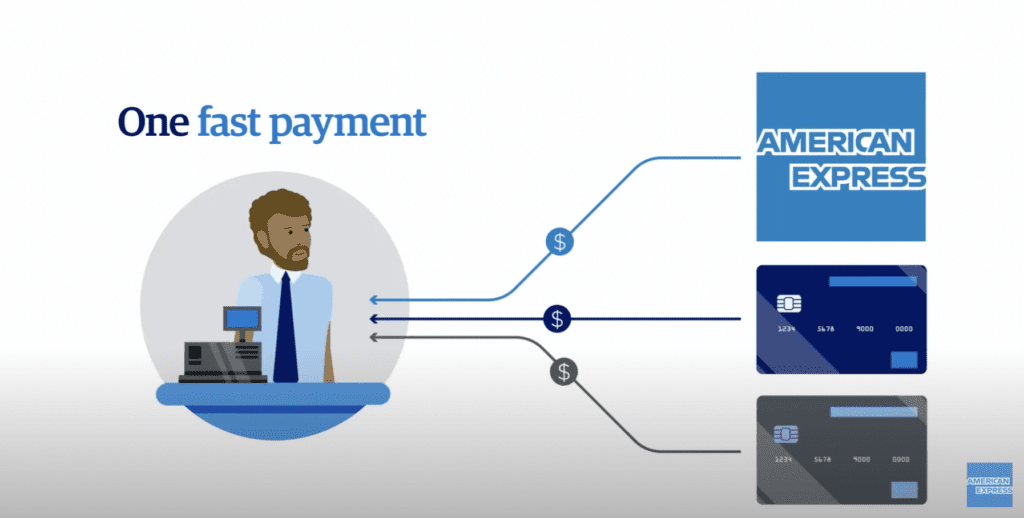

3 – One Fast Funding Deposit

Business owners love the fact their funds for processing American Express cards is deposited into their account the next day. With the AMEX OptBlue processing program, the funding path is the same as your merchant service provider provides.

No Longer Waiting For AMEX Funds

One of the things business owners were not happy about was, waiting for their AMEX finds. It usually took 2 – 3 days to see American Express card transactions show up in your deposits. Long gone are those days. Another huge benefit of the AMEX OptBlue card processing program.

4 – One Point Of Contact

This is another nice benefit of the American Express OptBlue program. Now should an issue arise with an AMEX card processing transaction, there will be one point of contact. This will be with your merchant service provider for all cards.

Easy And Streamlined

Now with OptBlue, you will enjoy having one point of contact. Your merchant service provider will handle all card inquiries. So much simpler than in the past.

Four Benefits Of AMEX OptBlue Final Thoughts

With out a doubt, the OptBlue card processing program is something EVERY merchant should have. It is by far and away, a HUGE win for any business model. Utah EZ Pay can get your business set up in just a few minuets. We truly hope you have enjoyed reading about the Four Benefits Of AMEX OptBlue program. Utah EZ Pay wants you to be in the know. Please leave a comment below as we wold like to read your thoughts.