5 Free PayAnywhere Credit Card Machines To Choose From 👍

Your business deserves the best in card processing rates and machines offered in the Salt Lake City area. Our goal in this merchant services article is to help your business succeed by showcasing innovative product offerings utilizing the latest tech options for your business.

We put together 5 Free PayAnywhere Credit Card Machines and 0% & .35% Rate options for you to choose from. Complete with corporate and local support from me personally or one of our dedicated team members if ever needed.

✔️

No

Contracts

✔️

Next

AM Funding

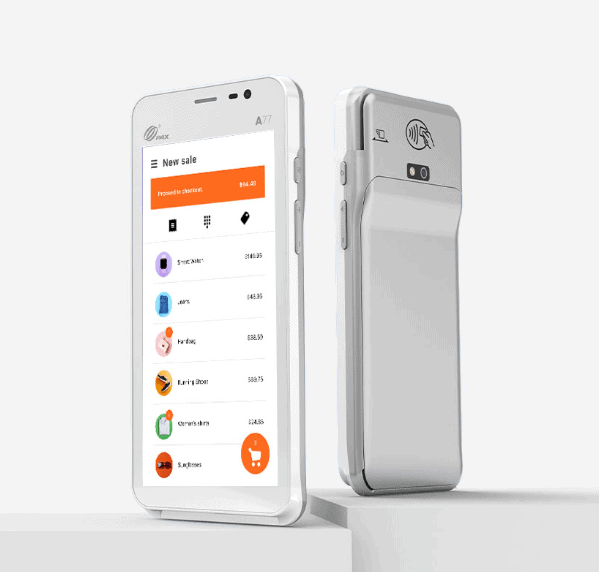

# 1. PayAnywhere Mini Mobile Credit Card Machine – PAX A77.

The Mobile PayAnywhere A77 Mini is a handheld, fully equipped smart credit card machine powered by the advanced functionality of PayAnywhere. It’s the perfect portable credit card reader for a number of businesses. Perfect for salons, pay-at-the-table restaurants, coffee shops, and delivery businesses. Receive the versatility to securely accept all payment types. Perfect for any Salt Lake City area business.

# 2. Free PayAnywhere Countertop Credit Card Machine – PAX A80 & SP30 PIN Pad.

One credit card machine (terminal) on your side of the counter and another terminal facing the customer with the “PIN Pro Smart” option. Offer your customers the latest payment options with a sleek payment device that provides maximum simplicity of use. This is perfect if you would like to keep using a keypad versus the touchscreen option.

# 3. Free PayAnywhere Mobile Credit Card Machine – PAX A920 Pro.

Everything you will need in a mobile credit card machine. This option comes fully equipped with the advanced functionality of our proprietary software. The PayAnywhere Smart Terminal is ideal for countertop, or anywhere you and your business will be. This is a must-have for mobile businesses.

# 4. PayAnywhere POS Plus Point Of Sale System – PAX E700.

With the PayAnywhere Smart POS, you can transform your countertop with a point of sale system designed specifically for your business model. Offering advanced features such as inventory, open tabs tracking and more. Enhance your Salt Lake City area business merchant services with fast and effortless transactions. This system includes a large format point of sale, business facing, 12.5″ HD touchscreen; a 4.3″ customer facing display; a receipt printer and a barcode scanner. This complete POS solution is ideal for established businesses for a variety of industries.

# 5. PayAnywhere 3-in-1 Bluetooth SmartPhone Card Reader.

Accept all credit cards on the go by easily transforming your smartphone or tablet into a portable PayAnywhere credit card machine. With payments powered PayAnywhere app with numerous features, you and your customers will enjoy fast and smooth transactions. Quickly connect your PayAnywhere bluetooth credit card reader to your iOS or Android smartphone and utilize the Pay AsYouGo Swipe Feature at 2.69%. Process nothing, pay nothing.

Choose Your Desired Card Processing Rate:

Mount Olympus .35%

(40% + savings – fees paid by business)

Mount Olympus (.35%) is an Interchange Plus Rate platform starting at .35% basis points or lower. Businesses pay the fees at an interchange rate.

- .35% Debit Cards With a PIN.

- 1.29% Debit & Credit Cards no PIN.

- 2.25 % AMEX / Rewards.

- 2.99% Manually Keyed-in Virtual Terminal.

- Average of All Cards = 1.72%.

Mount Timpanogos 0%

(90% + savings – fees included in sale total)

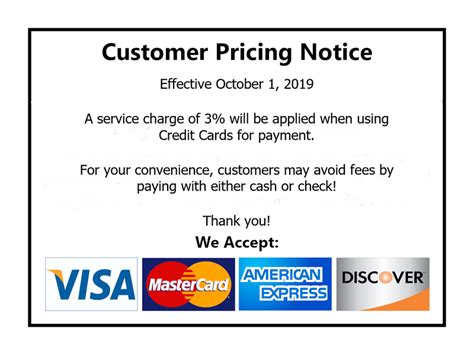

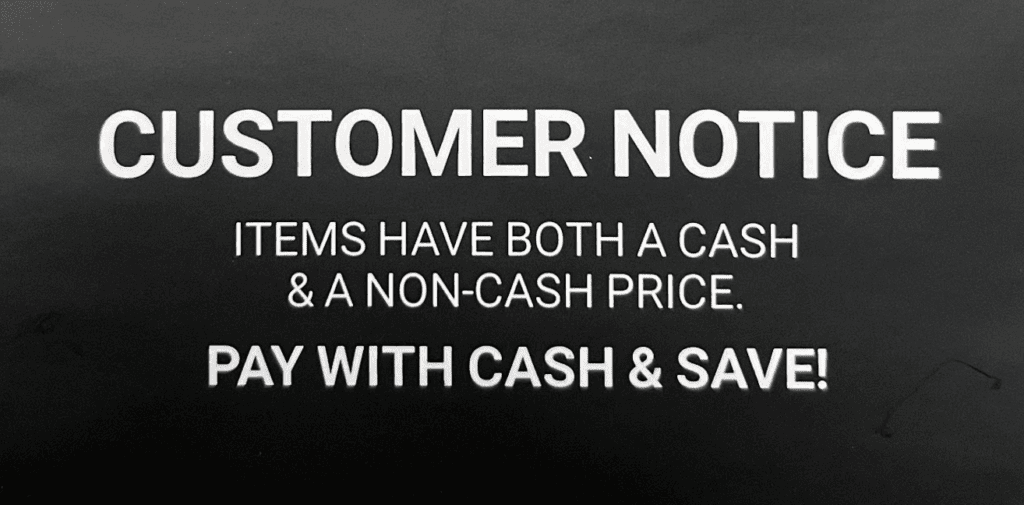

Mount Timpanogos (0%) is a 0% Rate Dual Pricing platform. The 4% processing fees are included in sale total. Or Customers can choose a 4% discount for paying cash.

- 0% Debit Cards With a PIN.

- 0% Debit & Credit Cards no PIN.

- 0% AMEX / Rewards.

- 0% Manually Keyed-in.

- Average of All Cards = 0%.

Get Started With Free PayAnywhere Credit Card Machines Today!

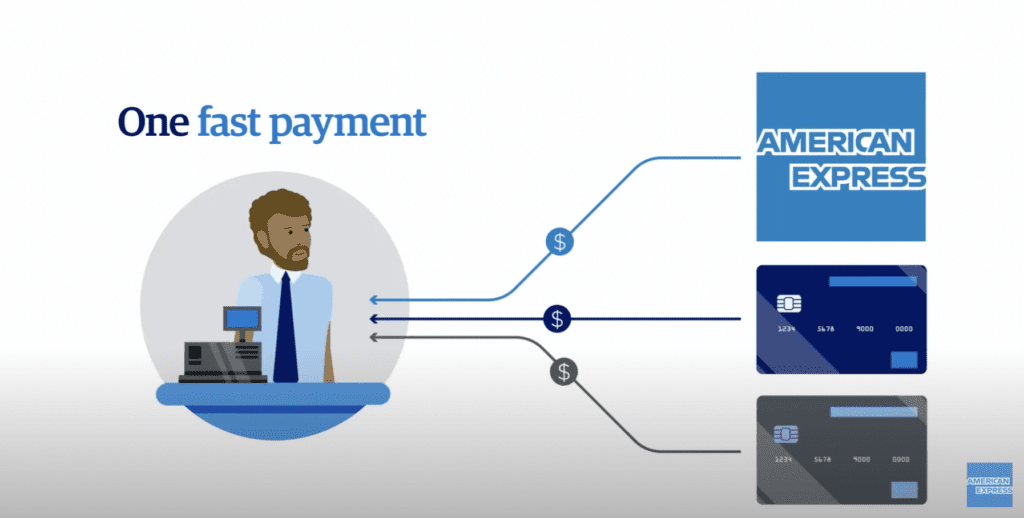

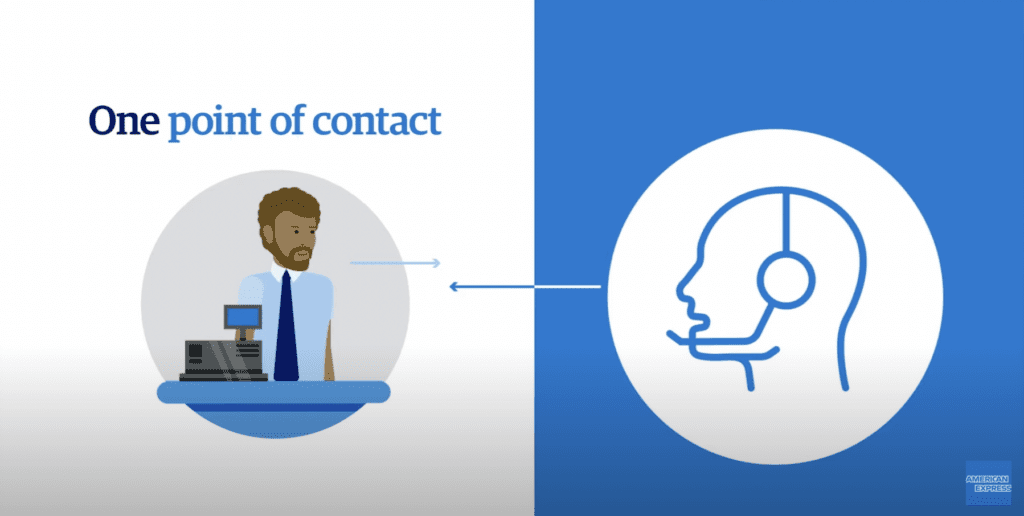

What makes Free PayAnywhere Credit Card Machines by Utah EZ Pay so good? Getting double support. Not only from NAB on the 1-877 corporate level, but also yours truly on the local Salt Lake City area level. Greg G Kapitan. You can call or text me at: 801-205-1955 anytime. We are here to help!